Services

New Business Owner Consultation

Have you started a business recently? Are you thinking about starting a business? As a new business owner, you oftentimes don’t know what you don’t know when it comes to accounting and bookkeeping.

I can save you time, money, and stress through a

One-Hour New Business Owner Consultation.

In our time together, we will discuss some accounting questions every new business owner should answer. This includes:

- What accounting systems/processes do I need?

- How do I understand what my financial statements are telling me?

- How do I stay compliant with business taxes?

- And more!

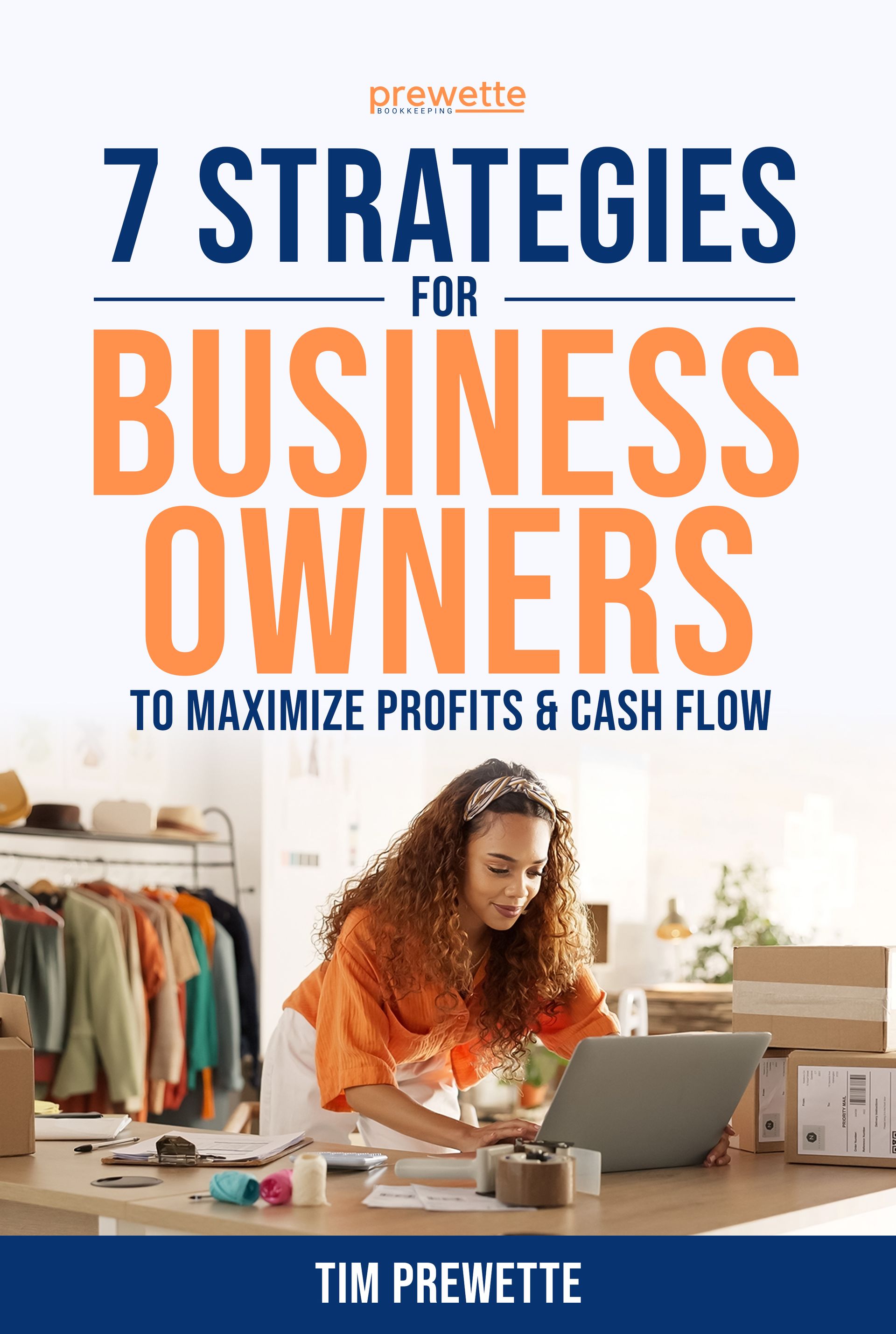

You will also receive this free ebook I wrote that has additional information, including tips for new business owners on how to develop a realistic budget.

Click HERE to schedule your one-hour consultation.

This consultation will save you time, money, and stress and is available for $199.

(Discounts available for college students and Connection Exchange referrals.)

Check Up Service

Want another pair of trained eyes to look through your books? My Check Up is a thorough books review of your:

- Company Setup and Configuration

- Bank Accounts and Reconciliations

- Chart of Accounts

- Transactions (Income and Expense)

- Undeposited Funds

- Products/Services List

- Vendor List and Customer List

- Inventory and Assets

- Accounts Payable and Accounts Receivable

- Financial Statements (Balance Sheet and Profit & Loss)

After my diagnostic review, you’ll receive a summary report detailing any issues I’ve discovered and recommendations on how to remedy them. You could handle these on your own, or I am happy to do them for you as well (see Clean Up Services below).

Set Up Service

Want to manage your own books but would like some help getting everything set up just right? I can help you set up your QuickBooks Online company file just the way you need it. I will:

- Customize chart of accounts, invoices, reports

- Set up products and services

- Connect bank accounts and credit card accounts

- Establish beginning balances

- Enter transactions since your starting date

- Enter outstanding accounts receivable and accounts payable details as of your starting date

- Find other tools/apps that may be helpful

…all to get you going so you can handle the day-to-day use of QuickBooks Online or Wave Accounting software.

Clean Up / Catch Up Service

Just need a little help getting cleaned up or caught up on everything?

I can help you with a “Clean up,” which is reviewing your books for a set timeframe (e.g., last 2 years) and correcting everything that needs to be corrected.

I can also perform a “Catch up,” which is getting current by entering new transactions and performing monthly reconciliations to-date.

Monthly Services

My main goal through

monthly bookkeeping

services is to provide

clear, accurate, and timely financials, which enables you to make decisions based on solid data. See the section below for information on the three different tiers of services.

Monthly Bookkeeping Services

I offer customizable bookkeeping and advisory support designed to save your business or nonprofit time and money. My services are tailored to fit your unique needs as they grow and change—no matter your industry, size, budget, or current systems. Let’s work together to help you reach your goals.

Tier One

Peace of mind every month

- Transaction Categorization

- Account Reconciliation

- Financial Reporting

- Class/Fund/Grant Tracking

- Semi-annual Strategy Meetings

- 72-hour response time

- Reports by the 20th of each month

Ideal for organizations that just want clean, accurate records and reliable monthly reporting

Tier Two

More visibility and real-time data

Tier 1 plus:

- Written Financial Insights

- Budget-to-Actual Analysis

- KPI Dashboard

- Quarterly Strategy Meetings

- 48-hour response time

- Reports by the 15th of each month

Ideal for organizations that also want financial insight and guidance

Tier Three

Strategic and proactive support

Tier 2 plus:

- SOP Documentation

- Grant Proposal Assistance

- Grant/Donor Reporting (NPO/Church)

- Monthly Strategy Meetings

- 24-hour response time

- Reports by the 10th of each month

Ideal for organizations that also want a proactive financial partner involved in ongoing planning and oversight